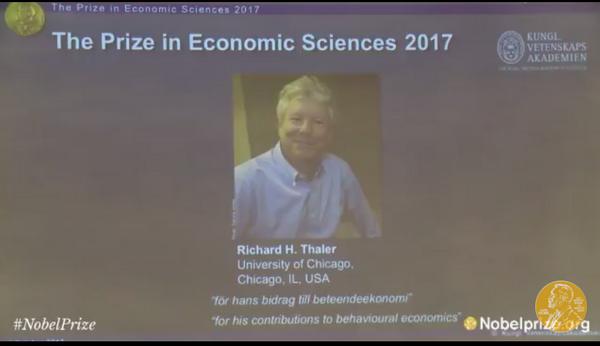

美国经济学家理查德·塞勒获2017年诺贝尔经济学奖

北京时间今天17:45,2017年诺贝奖经济学奖正式揭晓。瑞典皇家科学院宣布,因对“行为经济学”的贡献,芝加哥大学布斯商学院教授理查德·泰勒(Richard Thaler)获得诺贝尔经济学奖。

近十年来诺贝尔经济学奖都颁给了谁

2007年,美国经济学家莱昂尼德·赫维奇、埃里克·马斯金和罗杰·迈尔森。他们在创立和发展“机制设计理论”方面作出了贡献。“机制设计理论”最早由赫维奇提出,马斯金和迈尔森则进一步发展了这一理论。这一理论有助于经济学家、各国政府和企业识别在哪些情况下市场机制有效,哪些情况下市场机制无效。

2008年,美国经济学家保罗·克鲁格曼。克鲁格曼整合了此前经济学界在国际贸易和地理经济学方面的研究,在自由贸易、全球化以及推动世界范围内城市化进程的动因方面形成了一套理论。他的新理论能够帮助解释自由贸易和全球化对世界经济产生什么样的影响以及世界范围内城市化进程的驱动力等一系列重要问题。

2009年,美国经济学家埃莉诺·奥斯特罗姆和奥利弗·威廉森。奥斯特罗姆因为“在经济管理方面的分析、特别是对公共资源管理的分析”获奖,威廉森则因为“在经济管理方面的分析、特别是对公司边界问题的分析”获奖。埃莉诺·奥斯特罗姆和奥利弗·威廉森的研究证明了经济分析可用于解释大多数社会组织形式。奥斯特罗姆的研究揭示了使用者组织是如何有效管理公共资源的。威廉森的研究则发展了有关公司作为一些架构安排解决利益冲突的理论。

2010年,美国经济学家彼得·戴蒙德和戴尔·莫滕森,以及具有英国和塞浦路斯双重国籍的经济学家克里斯托弗·皮萨里季斯分享这一奖项。这三名经济学家凭借对“经济政策如何影响失业率”理论的进一步分析,摘得2010年诺贝尔经济学奖桂冠。三人的理论可以解释许多经济现象,包括“为何在存在很多职位空缺的时候,仍有众多人失业”。三人建立的经济模型还有助于人们理解“规章制度和经济政策如何影响失业率、职位空缺和工资”。

2011年,美国普林斯顿大学的克里斯托弗·西姆斯以及纽约大学的托马斯·萨金特。西姆斯的贡献主要集中于对时间序列计量经济学和应用宏观经济学领域的研究方面。他研究短期经济政策的作用,反映出对宏观政策效果的关注。而萨金特作为理性预期学派的领袖人物,在宏观经济模型中预期的作用、动态经济理论与时间序列分析的关系等研究领域颇有建树。

2012年,美国经济学家阿尔文·罗思和劳埃德·沙普利,以表彰他们在“稳定匹配理论和市场设计实践”上所作的贡献。沙普利采用了所谓的合作博弈理论并比较了不同的匹配方法。其研究重点是如何使双方不愿打破当前的匹配状态,以保持匹配的稳定性。罗思的贡献在于,他发现沙普利的理论能够阐明一些重要市场是如何在实践中运作的。通过一系列研究,他发现“稳定”是理解特定市场机制成功的关键因素。

2013年,美国经济学家尤金·法马、拉尔斯·彼得·汉森和罗伯特·席勒,他们因对资产价格的实证分析取得显著成就而获此殊荣。评选委员会指出,他们的研究成果奠定了人们目前对资产价格理解的基础,资产价格一方面依赖波动风险和风险态度,另一方面也与行为偏差和市场摩擦相关。

2014年,法国经济学家让·梯若尔。他被誉为当代“天才经济学家”,累计发表过300多篇论文和11本专著。在当代经济学三个最前沿的研究领域博弈论、产业组织理论和激励理论均做出了开创性的贡献。他以对市场力量与调控领域研究的贡献而获奖,并打破了多年来美国经济学家垄断经济学奖的现象。

2015年,拥有英国和美国双重国籍的普林斯顿大学教授、知名微观经济学家安格斯·迪顿因研究消费、贫困和福利方面获得当年诺贝尔经济学奖。安格斯·迪顿最主要的学术贡献在于提供了定量测量家庭福利水平的工具,以此来更准确地定义和测量贫困,对更加有效地制定反贫困政策有着重要意义。

2016年诺贝尔经济学奖揭晓,哈佛大学的奥利弗-哈特、麻省理工学院的本格特-霍斯特罗姆,获奖理由是他们对契约理论的贡献,他们的研究成果被誉为对于理解现实生活中的契约与制度,以及契约设计中的潜在缺陷十分具有价值。

新闻配图

【推荐阅读】历届诺贝尔经济学奖获得者(名单)

北京时间10月9日瑞典皇家科学院宣布,将2017年诺贝尔经济学奖授予美国经济学家理查德·塞勒(Richard H. Thaler),表彰其在行为经济学领域的贡献。理查德·塞勒是行为金融学奠基者之一,行为金融领域著名学者。

理查德·塞勒摄于2016年6月

在诺贝尔经济学奖正式公布之前,有“诺奖风向标”之称的“引文桂冠奖”发布了2017年经济学奖名单。而根据获奖名单,以下几位科研人员被认为最有可能在今年或不久的将来获得诺贝尔奖:

1. 加州理工学院的科林·凯莫勒(Colin Camerer)和卡耐基梅隆大学的乔治罗文斯坦(George Loewenstein),两位学者在行为经济学和神经经济学领域取得了开创性研究成果。

2. 斯坦福大学的罗伯特·霍尔(Robert Hall),他的代表性研究领域为劳动者生产率、经济衰退和失业。

3. 哈佛大学的迈克尔·詹森(Michael Jensen)、麻省理工学院的斯特沃特·梅耶斯(Stewart Myers)以及芝加哥大学的拉格拉姆·拉扬(Raghuram Rajan)。三位学者在企业融资领域取得了重大研究成果。拉格拉姆·拉扬还曾任国际货币基金组织(IMF)首席经济学家以及印度央行行长。

在“引文桂冠奖”的名单中,并没有看到理查德·塞勒的身影。由此可见,理查德·塞勒此次可谓是爆冷获奖。

以下为理查德·泰勒的个人简历:

个人信息:生于1945年9月12日

出生地:新泽西州东橙市

教育经历:

1967年,学士学位,凯斯西储大学

1970年,硕士学位,罗切斯特大学

1974年,博士学位,罗切斯特大学

博士学位论文:"The Value of Saving A Life: A Market Estimate"(导师:SherwinRosen)

当前职位(1995年7月至今):

芝加哥大学布斯商学院,决策研究中心主任,经济学与行为科学专业Charles R Walgreen特殊服务教授。

美国国家经济研究院(NBER)研究员

荣誉:

美国艺术与科学院会员,美国金融学会研究员,计量经济学会研究员,美国经济学会主席,TIAA-CREF萨缪尔森奖,Keil全球经济奖,CFA研究院Nicholas Molodovsky奖。

其他工作经历: Thaler的研究工作经历非常丰富,1971年至1998年在罗切斯特大学、斯坦福大学、卡耐基大学、不列颠哥伦比亚大学、赛奇基金会、麻省理工学院等机构工作。

出版书籍:

1、Misbehaving: TheMaking of Behavioral Economics,2015年出版。

2、Improving Decisions on Health, Wealth, and Happiness,2008。

3、Advances in Behavioral Finance, editor,1993。

4、The Winner's Curse: Paradoxes and Anomaliesof Economic Life,1991。

5、Quasi-Rational Economics,1991。

发表论文:

Rosen, Sherwin and Richard H.Thaler."The Value of Saving A Life: Evidence From The Labor Market,"In Household Production and Consumption, edited by Nester Terleckyj. NationalBureau of Economic Research, (1975): 265-298.

Lasky, Jeffrey and Richard H. Thaler."Design Requirements for Criminal Justice Research and ResourceManagement/Planning Systems." In Proceedings of the Second InternationalSymposium of Criminal Justice Information and Statistics Systems, 1976.

Thaler, Richard H., "On Optimal SpeedLimits." In Auto Safety Regulation: The Cure or the Problem? edited byHenry Manne and Roger Miller, 1976.

Rosen, Sherwin and Richard H. Thaler."Some Results of Research on the Value of Saving Lives." InProceedings of a Workshop on the Measure of Intangible Environmental Impacts. ElectricPower Institute, 1977.

Thaler, Richard H., "An EconometricAnalysis of Property Crime: Interaction Between Police and Criminals."Journal of Public Economics; 8(1) (1977): 37-51. Thaler, Richard H. "A Note on theValue of Crime Control: Evidence from the Property Market." Journal ofUrban Economics, 5 (1978): 137-145.

Mayers, David and Richard H. Thaler,"Sticky Wages and Implicit Contracts: A Transactional Approach."Economic Inquiry October 17(4) (1979): 559-574.

Thaler, Richard H., "Discounting withFiscal Constraints: Why Discounting is Always Right." Defense ManagementJournal October 15 (1979): 2.

Thaler, Richard H., "Toward A PositiveTheory of Consumer Choice." Journal of Economic Behavior and Organization,1 (1980): 39-60. Reprinted edition. Edited by Breit and Hochman. (1985).

Shefrin, H.M. and Richard H. Thaler,"Interpreting Rationality in Hierarchical Games." Economic Letters,(1980).

Thaler, Richard H., "Judgment andDecision Making Under Uncertainty: What Economists Can Learn fromPsychology." Risk Analysis in Agriculture: Research and EducationalDevelopments. Presented at a seminar sponsored by the Western Regional ResearchProject W-149, Tucson, Arizona, June 1980.

Shefrin, H. M. and Richard H. Thaler,"An Economic Theory of Self-Control." Journal of Political EconomyApril, 89(2) (1981): 392-406.

Thaler, Richard H., "Maximization andSelf-Control," a commentary on "Maximization Theory in BehavioralPsychology," by Rachlin, Battalio, Kagel and Green, in The Behavioral andBrain Sciences, 1981.

Thaler, Richard H., "Some EmpiricalEvidence on Dynamic Inconsistency." Economic Letters 8 (1981): 201-207.

Gould, William and Richard H. Thaler,"Public Policy Toward Life Saving: Should Consumer Preferences Rule?"Journal of Policy Analysis and Management, (1982).

Thaler, Richard H., "Precommitment andthe Value of a Life." In The Value of Life and Safety. Edited by MichaelJones-Lee. North-Holland Press, 1982.

Thaler, Richard H., "TransactionUtility Theory." Paper presented during the proceedings of the Associationfor Consumer Research Conference, San Francisco, 1983. Thaler, Richard H., "Illusions,Mirages, and Public Policy." Public Interest Fall, (1983). Thaler, RichardH., "Illusions, Mirages, and Public Policy." In Judgment and DecisionMaking: An Interdisciplinary Reader. Edited by Hal Arkes and Kenneth Hammond.Cambridge University Press, 1986.

Thaler, Richard H., "Illusions,Mirages, and Public Policy." In Environmental Impact, Assessment,Technology Assessment and Risk Analysis. Edited by V.T. Covello et al. NATO ASISeries, 1983.

Thaler, Richard H. and Kathy Utgoff."An Economic Analysis of Multiyear Procurement." In OperationsResearch in Cost Analysis. Edited by Gerald R. McNichols. Operations ResearchSociety of America, 1984.

Thaler, Richard H., "Mental Accountingand Consumer Choice." Marketing Science, 4 (1985): 1999-214.

De Bondt, Werner F.M. and Richard H.Thaler,"Does the Stock Market Overreact?" Journal of Finance, 40(1985): 793-805.

Russell, Thomas and Richard H. Thaler,"The Relevance of Quasi Rationality in Competitive Markets." AmericanEconomic Review 75 (1985): 1071-1082. (Reprinted and corrected version fromQuasi Rational Economics).

Kahneman, Daniel, Jack Knetsch and RichardH. Thaler."Fairness and the Assumptions of Economics," Journal ofBusiness 59(4), (1986): S285-300.

Thaler, Richard H., "The Psychologyand Economics Conference Handbook: Commentary on papers by H. Simon, H. Einhornand R. Hogarth, and A. Tversky and D. Kahneman." Journal of Business,(1986).

Kahneman, Daniel, Jack Knetsch and RichardH. Thaler. "Fairness as a Constraint on Profit-Seeking: Entitlements inthe Market" American Economic Review 76(4), (1986): 728-741.

De Bondt, Werner F.M. and Richard H.Thaler, "Further Evidence on Investor Overreaction and Stock MarketSeasonality" Journal of Finance 42, (1987): 557-581.

Thaler, Richard H., "The Psychology ofChoice and the Assumptions of Economics." In Laboratory Experiments inEconomics: Six Points of View. Edited by Alvin Roth. Cambridge UniversityPress, 1987.

Shefrin, H.M. and Richard H. Thaler,"The Behavioral Life-Cycle Hypothesis." Economic Inquiry 26(4),(1988): 609-643. Thaler, Richard H. and Eric Johnson,"Gambling with the House Money and Trying to Break Even: The Effects ofPrior Outcomes in Risky Choice." Management Science 36(6), (1990):643-660.

De Bondt, Werner F.M. and Richard H.Thaler, "Do Security Analysts Overreact?" American Economic Review80(2), (1990): 52-57.

Kahneman, Daniel, Jack Knetsch and RichardH. Thaler, "Experimental Tests of the Endowment Effect and the CoaseTheorem" Journal of Political Economy 98(6), (1990): 1325-1348.

Kahneman, Daniel, Jack Knetsch and RichardH. Thaler, "Experimental Tests of the Endowment Effect and the Coase Theorem"In Recent Developments in Experimental Economics. Edited by John Hey and GrahamLoomes, 1992.

Lee, Charles, Andrei Schleifer and RichardH. Thaler, "Investor Sentiment and the Closed-end Fund Puzzle."Journal of Finance 46, (1991): 75-109.

Kahneman, Daniel and Richard H. Thaler,"Economic Analysis and the Psychology of Utility: Applications toCompensation Policy." American Economic Review 81, (1991): 341-346.

Lakonishok, Josef, Andrei Schleifer,Richard H. Thaler and Robert Vishny. "Window Dressing by Pension FundManagers." American Economic Review 81, (1991): 227-231.

Thaler, Richard H., "How to Get RealPeople to Save." In Personal Savings, Consumption, and Tax Policy. Editedby Marvin Kosters.Washington D.C.: American Enterprise Institute, 1992.

Thaler, Richard H., "Saving and MentalAccounting." In Choices over Time. George Loewenstein and Jon Elster. NewYork: Russell Sage Foundation, 1992.

Chopra, N., C. Lee, Andrei Shleifer andRichard H. Thaler, "Yes, Discounts on Closed-End Funds Are a SentimentIndex."Journal of Finance 48, (1993): 801-808.

Chopra, N., C. Lee, Andrei Shleifer andRichard H. Thaler, "Summing Up." Journal of Finance 48,(1993):811-812.

Thaler, Richard H., "Psychology andSavings Policies." American Economic Review Papers and Procedings 84(2),(1994): 186-192. Thaler, Richard H. and J. Peter Williamson,"College and University Endowment Funds: Why Not 100% Equities."Journal of Portfolio Management 21(1), (1994): 27-37.

De Bondt, Werner F.M. and Richard H.Thaler, "Financial Decision Making in Markets and Firms" In Finance.Edited by R. Jarrow, V Maksimovic, and W. T. Ziemba. Elsevier-North Holland:Series of Handbooks in Operations Research and Management Science, 1995.

Bernartzi, Shlomo and Richard H. Thaler,"Myopic Loss Aversion and the Equity Premium Puzzle." QuarterlyJournal of Economics CX, (1995): 73-92.

Michaely, Roni, Richard H. Thaler and KentWomack, "Price Reactions to Dividend Initiations and Omissions:Overreaction or Drift?" Journal of Finance 50(2), (1995): 573-608.

Thaler, Richard H., "How to EvaluateSavings Programs: Discussion of Papke, Peterson and Poterba." In Papers inthe Economics of Aging. Edited by David A. Wise. Chicago: University of ChicagoPress, 1995.

Thaler, Richard H., "Doing Economicswithout Homo Economicus." In Exploring the Foundations of Research inEconomics: How Should Economists Do Economics? Edited by Steven G. Medema andWarren J. Samuels, 1996.

Thaler, Richard H., "Irving Fisher:Modern Behavioral Economist." American Economic Review 87(2),(1997):439-441.

Kahneman, Daniel, Alan Schwartz, Richard H.Thaler and Amos Tversky, "The Effect of Myopia and Loss Aversion on RiskTaking: An Experimental Test." Quarterly Journal of Economics 112(2),(1997):647-661.

Camerer, Colin, Linda Babcock, GeorgeLoewenstein and Richard H. Thaler. "Labor Supply of New York City CabDrivers: One Day at a Time." Quarterly Journal of Economics 112(2),(1997): 407-441.

Bernartzi, Shlomo, Roni Michaely andRichard H. Thaler. "Do Changes in Dividends Signal the Future or thePast?" Journal of Finance 52(3), (1997): 1007-1033.

Thaler, Richard H., Amos Tversky and PeterWakker. "Probabilistic Insurance." Journal of Risk and Uncertainty15(1), (1997): 7-28.

Canina, Linda Roni Michaely, Richard H.Thaler and Kent Womack. "Caveat Compounder: A Warning about Using the CRSPEqually Weighted Index to Compute Long-Run Excess Returns." Journal ofFinance 53, (1998):403-416. Jolls, Christine, Cass Sunstein and RichardH. Thaler. "A Behavioral Approach to Law and Economics." Stanford LawReview 50, (1998): 1471-1450.

Jolls, Christine, Cass Sunstein and RichardH. Thaler. "Theories and Tropes: A Reply to Posner and Kelman."Stanford Law Review 50, (1998): 1593-1608.

Thaler, Richard H., "Giving Markets aHuman Dimension." In The Complete Finance Companion, 1998.

Thaler, Richard H., "Giving Markets aHuman Dimension." Financial Times section Mastering Finance, June 16th, 6.

Bernartzi, Shlomo and Richard H. Thaler."Risk Aversion or Myopia? Choices in Repeated Gambles and RetirementInvestment." Management Science 45, (1999): 364-381.

Thaler, Richard H. "Mental AccountingMatters." Journal of Behavioral Decision Making 12(3), (1999): 183-206.

Thaler, Richard H., "The End ofBehavioral Finance." Financial Analysts Journal 56(6), (1999): 12-17.

Thaler, Richard H., "From HomoEconomicus to Homo Sapiens." Journal of Economics Perspectives 14:(2000):133-141.

Bernartzi, Shlomo and Richard H. Thaler."Naive Diversification in Defined Contribution Savings Plans."American Economics Review 91(1), (2001): 79-98.

Knetsch, Jack, Fang-Fang Tang and RichardH. Thaler. "The Endowment Effect and Repeated Market Trials: Is theVickrey Auction Demand Revealing?" Experimental Economics 4(3), (2002):257-269.

Bernartzi, Shlomo and Richard H. Thaler,"How Much is Investor Autonomy Worth?" Journal of Finance 57, (2002):1593-1616.

Lamont, Owen and Richard H. Thaler,"Can the Stock Market Add and Subtract? Mispricing in Tech StockCarve-Outs." Journal of Political Economy 111(2), (2003): 227-268.

Sunstein, Cass and Richard H. Thaler,"Libertarian Paternalism is Not an Oxymoron." University of ChicagoLaw Review 70 (4), (2003): 1159-1202.

Sunstein, Cass and Richard H. Thaler,"Libertarian Paternalism." The American Economics Review 93 (2),(2003): 175-179.

Richard H. Thaler and Shlomo Bernartzi,"Save More Tomorrow: Using Behavioral Economics in Increase EmployeeSavings." Journal of Political Economy 112(1), (2004): S164-S187.

Cronqvist, Henrik and Richard H.Thaler,"Design Choices in Privatized Social-Security Systems: Learningfrom the Swedish Experience" The American Economics Review 94 (2), (2004):424-428.

Sunstein, Cass and Richard H. Thaler,"Market Efficiency and Rationality: The Peculiar Case of Baseball"Michigan Law Review 102 (6):1390-1403.

Thaler, Richard H. and SendhilMullainathan. “Behavioral Economics.” In International Encyclopedia of theSocial and Behavioral Sciences, Neil Smelser and Paul Bates, Editors, (2001).

Thaler, Richard H, Benartzi, Shlomo, Utkus,Stephen P & Sunstein, Cass R, "The Law and Economics of Company Stockin 401(k) Plans," Journal of Law & Economics 50 (1), (2007): 45-79.

Barberis, Nicholas, Huang, Ming and Thaler,Richard H., “Individual Preferences, Monetary Gambles, and Stock MarketParticipation: A Case for Narrow Framing” American Economic Review 96 (4),(2006): 694-712.

Thaler, Richard H., E Shafir “Invest Now,Drink Later, Spend Never: On the Mental Accounting of Delayed Consumption,Journal of Economic Psychology, 2006 – Elsevier.

Gustavo Grullon & Roni Michaely &Shlomo Benartzi & Richard H. Thaler, 2005. "Dividend Changes Do NotSignal Changes in Future Profitability," Journal of Business, Universityof Chicago Press, vol. 78(5):1659-1682.

Shlomo Benartzi & Richard Thaler, 2007."Heuristics and Biases in Retirement Savings Behavior," Journal ofEconomic Perspectives, American Economic Association, Vol. 21(3): 81-104,Summer.

Richard H. Thaler and Cass R. Sunstein.Nudge: Improving Decisions about Health, Wealth and Happiness, Yale UniversityPress, 2008 Post, T., Van den Assem, MJ., Baltussen, Gand Thaler, Richard H. , “Deal or No Deal? Decision Making Under Risk in aLarge-Payoff Game Show”, American Economic Review 98 (1), (2008): 38-71.

William C. Weld & Roni Michaely &Richard H. Thaler & Shlomo Benartzi, "The Nominal Share PricePuzzle," Journal of Economic Perspectives, American Economic Association,Vol. 23(2):121-42, Spring 2009.

Shlomo Benartzi, Alessandro Previtero, andRichard H. Thaler, “Annuitization Puzzles”, Journal of Economic PerspectivesVol 25:143-164, Fall 2011.

Emir Kaminica, Sendhil Mullainathan andRichard H. Thaler, “Helping Consumers Know Themselves”, American EconomicsReview Papers and Procedings, Vol 101, May 2011, 417-422.

Martijn J. van den Assem, Dennie van Dolderand Richard H. Thaler “Split or Steal? Cooperative Behavior When the Stakes AreLarge” Management Science, Vol 58, No. 1, January 2012.

B. Cade Massey and Richard H. Thaler “TheLoser’s Curse: Decision Making and Market Efficiency in the National FootballLeague Draft” Management Science, Vol 59 (7) 1479-1495.

Shlomo Benartzi and Richard H. Thaler,“Behavioral Economics and the Retirement Savings Crisis” Science, Vol 333,March 8, 2013.

Richard H. Thaler, Cass R. Sunstein, andJohn P. Balz, “Choice Architecture” The Behavioral Foundations of PublicPolicy, Eldar Shafir, (ed) 2014.

Van Dolder, Dennie, Martijn J. van denAssem, Colin F. Camerer, and Richard H. Thaler. 2015. "Standing United orFalling Divided? High Stakes Bargaining in a TV Game Show." AmericanEconomic Review, 105(5): 402-07.